Introduction:

The financial services industry has always been at the forefront of technology adoption, and with the emergence of GPT-4, the industry is poised to be disrupted once again. In this blog post, we will explore the potential impact of GPT-4 on the financial services industry and how financial services providers can take advantage of this opportunity.

What is GPT-4?

GPT-4 is AI model that can handle multiple modes of input, such as text, images, and audio. It is trained on vast amounts of data and can provide a much more comprehensive understanding of the data. For instance, a large multimodal model could analyze both text and images and identify potential risks to the financial system in social media posts and images.

GPT-4 will catalyse new products, services and business models

GPT-4 will drive new products, services, and business models in the financial services industry by enabling a more comprehensive understanding of data. Here are a few examples:

- Fraud Detection: GPT-4 could be used to analyze multiple types of data, such as transactional data, social media posts, and images, to identify potential fraud risks. By analyzing multiple types of data, GPT-4 can provide a much more comprehensive understanding of the data and can identify potential fraud risks more accurately.

- Customer Insights: GPT-4 could be used to analyze customer data, such as transactional data, social media posts, and customer feedback, to provide a more comprehensive understanding of customer needs. This could help financial services providers to develop new products and services that better meet customer needs.

- Risk Management: GPT-4 could be used to analyze multiple types of data, such as economic data, news articles, and social media posts, to identify potential risks to the financial system. By analyzing multiple types of data, GPT-4 can provide a much more comprehensive understanding of the data and can identify potential risks more accurately.

GPT-4 will Transform Current Products, Services and Processes

GPT-4 will transform the current products and services in the financial services industry by enabling a more comprehensive understanding of data. Here are some examples:

- Personalized Financial Advice: GPT-4 could be used to analyze customer data, such as transactional data, social media posts, and customer feedback, to provide personalized financial advice to customers.

- Automated Trading: GPT-4 could be used to analyze multiple types of data, such as economic data, news articles, and social media posts, to provide automated trading recommendations.

- Improved Credit Scoring: GPT-4 could be used to analyze multiple types of data, such as transactional data, social media posts, and customer feedback, to provide a more comprehensive understanding of customer creditworthiness.

- Automated Insurance Underwriting: GPT-4 could be used to analyze multiple types of data, such as customer data, social media posts, and public records, to provide automated insurance underwriting.

- Enhanced Customer Service: GPT-4 could be used to analyze customer data, such as transactional data, social media posts, and customer feedback, to provide enhanced customer service. This could include personalized recommendations, faster resolution of customer issues, and improved customer experiences.

What should Financial Institutions do?

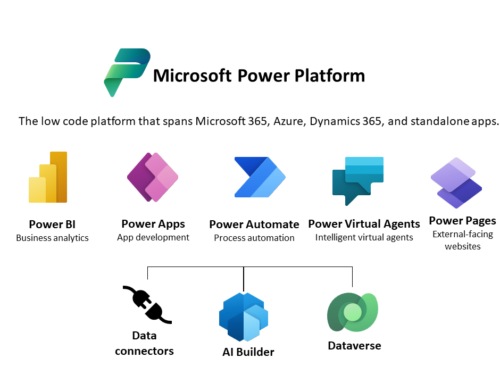

To encash these opportunities, financial institutions need to focus on building the necessary infrastructure to support GPT-4. This may include investing in high-performance computing resources and developing partnerships with technology providers. Financial services providers should also focus on building a culture of innovation and experimentation to enable the development of new products and services.

Potential Pitfalls

Despite the potential benefits of GPT-4, there are potential pitfalls that financial services providers should be aware of. These include issues around data privacy and security, bias in the data and algorithms, and the potential for such technologies to perpetuate existing inequalities.

Selecting the Right Systems Development and Integration Partner

Financial services providers should look for a partner with a deep understanding of the financial services industry and the ability to develop and deploy GPT-4. The partner should also have experience working with large amounts of data and should be able to ensure data privacy and security. Additionally, the partner should be able to work collaboratively with the financial services provider to develop innovative solutions that meet the specific needs of the industry.